Legacy processors were not built for developers or AI agents. We were.

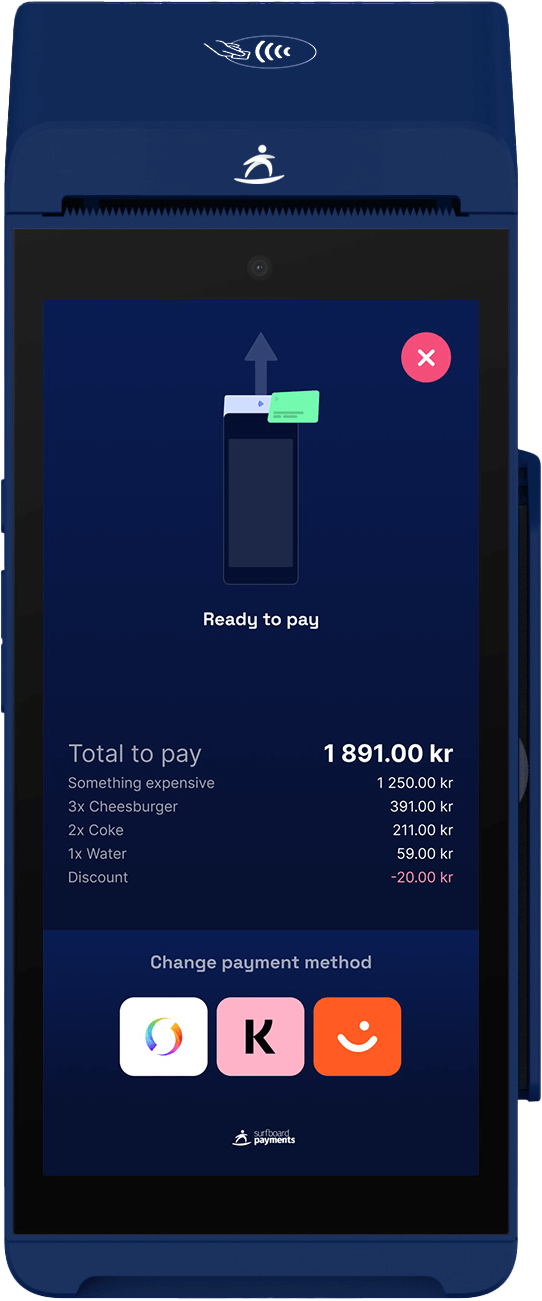

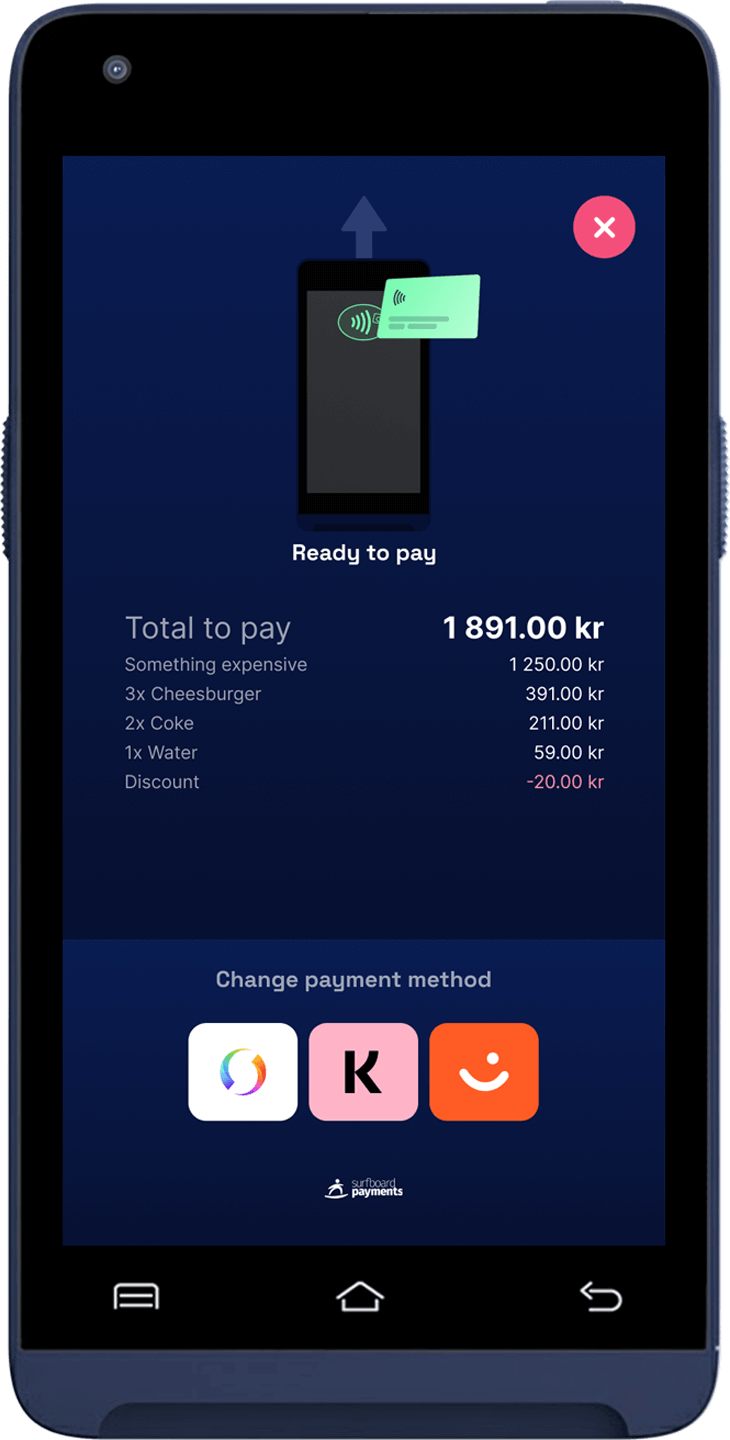

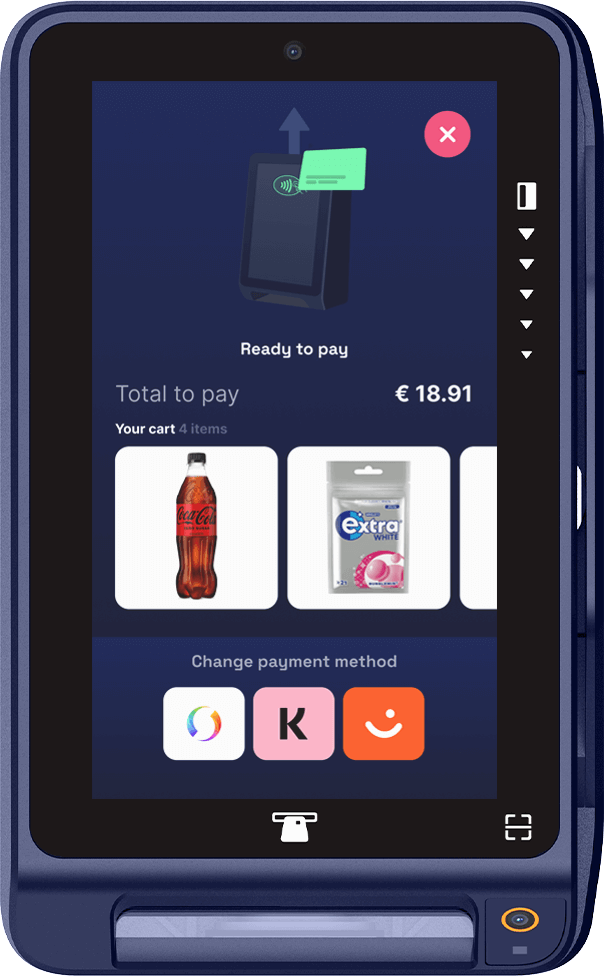

Surfboard is acquiring-agnostic, multi-cloud, and completely API-first. Every part of the payment flow is programmable, open, and fast. Built for both human developers and autonomous systems.

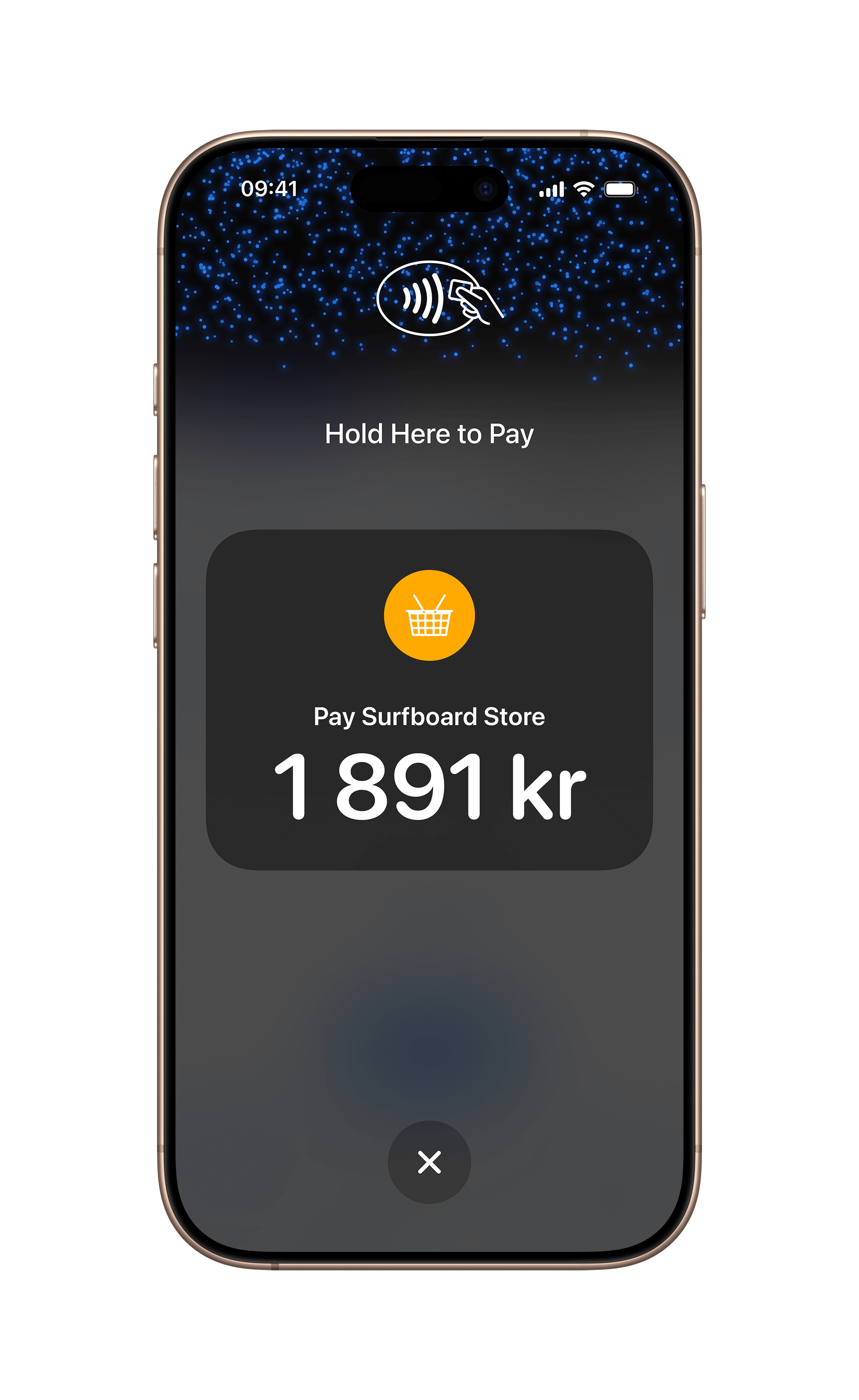

Integrate once, and you get everything: merchant onboarding, terminals, SoftPOS, online checkout, tips, tokenization, analytics, all through the same API. Our developer resources are fully addressable by LLMs, so you can use ChatGPT, Claude, or any AI coding assistant to integrate at record speed.

Instant sandbox access

LLM-ready docs (llms.txt)

Agent-ready endpoints

MCP server & OpenAPI specs